ACCE, SEIU, Occupy Bernal, and Occupy Noe Foreclosure and Eviction Fighters and supporters again provided important testimony about the illegal, predatory, and discriminatory practices of banks like Wells Fargo, JP Morgan Chase, and Bank of America at the meeting of the San Francisco Employee Retirement System Retirement Board on March 13, 2013, just as previously on January 9, 2013 and on February 13, 2013.

The group again asked the Retirement Board to investigate the illegal, predatory, and discriminatory practices of the banks, to request that the banks stop these practices, to sponsor shareholder resolutions if they don’t stop, and to divest from the banks’ stocks if the shareholder resolutions do not succeed. Some of the Commissioners responded favorably to the public comment testimony.

Media coverage: San Francisco Business Times KCBS (including audio segment)

Videos:

Grace Martinez of ACCE provides testimony to SFERS Retirement Board.

Foreclosure and Eviction Fighter Gladys Dewitt provides testimony to SFERS Retirement Board.

SFERS Retirement Board President Wendy Paskin-Jordan, a former Wells Fargo employee, responds to public testimony.

San Francisco Muni employee and Local 200 former President Alice Fialkin provides testimony to SFERS Retirement Board.

Foreclosure and Eviction Fighter Ian Haddow provides testimony to SFERS Retirement Board.

Former San Francisco city employee Susan McDonough provides testimony to SFERS Retirement Board.

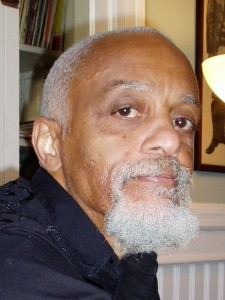

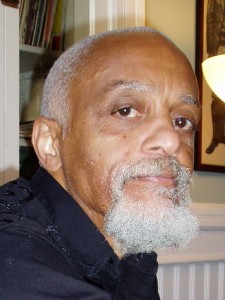

Foreclosure and Eviction Fighter Larry Faulks, evicted from his home by Wells Fargo, provides testimony to SFERS Retirement Board.

Foreclosure and Eviction Fighter and Teamster Ricardo Rodriguez provides testimony to SFERS Retirement Board.

Harry Baker, Retirement Security Chair for SEIU Local 1021, which is the largest union representing SFERS members, provides testimony to SFERS Retirement Board.

Foreclosure and Eviction Fighter Jackie Wright provides testimony to SFERS Retirement Board.

Grace Martinez of ACCE provides testimony to SFERS Retirement Board.

SFERS Retirement Board staff and commissioners discuss whether they can calendar consideration of a resolution on foreclosures and related evictions at the next SFERS meeting in April 2013.

SFERS Retirement Board staff and commissioners continue discussing whether they can calendar consideration of a resolution on foreclosures and related evictions at the next SFERS meeting in April 2013.

The rest of the discussion was not captured on video.

#1 in SF Foreclosures and Related Evictions: Racist and Predatory

#1 in SF Foreclosures and Related Evictions: Racist and Predatory

Who: (Retired and Current) City Employees, especially those facing foreclosure/eviction and supporters

What: Public Comment at San Francisco Employees Retirement System (SFERS) Retirement Board Meeting (2 minute limit)

When: 2:00pm, Wednesday, March 13

Where: 30 Van Ness Avenue, 3rd floor (near Market Street)

We are asking SFERS to do the following:

- Investigate investments in Wells Fargo, which is #1 in foreclosures and related evictions in San Francisco and elsewhere, as well as other lenders foreclosing on and evicting San Francisco homeowners..

- Prepare and submit a Wells Fargo shareholder resolution to stop predatory and/or racist foreclosures and related evictions for consideration at the next annual Wells Fargo shareholder meeting (probably in April 2013).

- If Wells Fargo doesn’t adopt the shareholder resolution at its next shareholder meeting and take immediate steps to implement policies and practices in line with the resolution, then divest from any investment in Wells Fargo within three months after that shareholder meeting.

We are asking San Francisco Mayor Lee to do the following:

- Appoint only qualified candidates to the SFERS Retirement Board who are not executives or employees at Wells Fargo, JP Morgan Chase, or Bank of America (the top three in predatory foreclosures and related evictions in San Francisco).

- Issue a statement in support of divestment from Wells Fargo of all San Francisco City and County funds, including employee retirement and disability funds.

Background:

The San Francisco Employee Retirement Systems (SFERS) handles investments for pension funds for current and retired San Francisco city employees. SFERS has policies that include “Social Investment Procedures” adopted at the SFERS Retirement Board meeting of September 27, 1988, which requires the SFERS Retirement Board when making investments in stocks, mutual funds, and so on, to consider:

“Community Relations: the relationship of the corporation to the communities in which it operates shall be maintained as a good corporate citizen through observing proper environmental standards, supporting the local economic, social and cultural climate, conducting acquisitions and reorganizations to minimize adverse effects and not discriminate in making loans or writing insurance.” (emphasis added by Occupy the Auctions)

Wells Fargo is #1 in San Francisco foreclosures. San Francisco’s Mayor and Board of Supervisors have unanimously requested a halt to foreclosures and related evictions, especially since San Francisco Assessor-Recorder’s report showing that 84% of foreclosures have at least one legal violation and due to Wells’ $175 million settlement with the United States Department of Justice paid in response to allegations of racial discrimination in providing mortgage loans in San Francisco’s Bayview-Hunters Point and other neighborhoods.

Wells Fargo’s “waterfall” model, along with similar policies from other lenders, ensures that the bank can squeeze the most money possible from homeowners struggling to make payments while finally discarding them like trash if the bank can’t make a profit on every single loan. Running a mortgage loan business means assuming risks, especially after receiving billions in bailout funds from the taxpayers, many of whom are Wells’ mortgage loan borrowers.

Wells Fargo is putting 32 families at risk of losing their homes due to foreclosure and related evictions during this holiday season. Wells Fargo is foreclosing on and evicting veterans and disabled and senior homeowners and families with children, as well as targeting homeowners with life-threatening illnesses. Wells Fargo has engaged in predatory, fraudulent, and racist lending practices and has contributed to a rash of foreclosure deaths.

This alert brought to you by ACCE, Occupy Bernal, and other supportive organizations coordinated within the Occupy the Auctions and Evictions campaign.

Links: SFERS Meeting on January 9, 2013 Wells 29 Action Alert Wells 32 Action Flyer (four to page) Wells Pays $175 Million to Resolve Allegations of Racial Discrimination in Providing Mortgage Loans Occupy Our Homes Wells Fargo Bayview Branch Action Occupy Wells Fargo Noe Branch Occupy Wells Fargo HQ Occupy Senior and Veteran Evictions and Foreclosures (Occupy Anniversary) Upcoming Bank Auctions of Foreclosure/Eviction Fighter Homes Foreclosure/Eviction Fighter Profiles

For updates and this action alert: http://occupytheauctions.org/wordpress/?p=8449