Update as of 3:57pm on December 6, 2012: The protest was an amazing success as more than 60 organizers occupied and shut down the Bayview branch of Wells Fargo in San Francisco as part of a nationwide Occupy Our Homes anniversary day of actions. The protestors chanted “Stop the Evictions, Stop the Foreclosures”, “Save the Wells 27” (click on the link to call and email in support of the 27 San Francisco families at risk of Wells Fargo foreclosures and evictions during the holiday season), and other slogans, as well as decorating the interior and exterior of the bank branch with crime scene tape, displaying banners and placards, and chalking body shapes and slogans on the sidewalk in front of the branch.

Update as of 3:57pm on December 6, 2012: The protest was an amazing success as more than 60 organizers occupied and shut down the Bayview branch of Wells Fargo in San Francisco as part of a nationwide Occupy Our Homes anniversary day of actions. The protestors chanted “Stop the Evictions, Stop the Foreclosures”, “Save the Wells 27” (click on the link to call and email in support of the 27 San Francisco families at risk of Wells Fargo foreclosures and evictions during the holiday season), and other slogans, as well as decorating the interior and exterior of the bank branch with crime scene tape, displaying banners and placards, and chalking body shapes and slogans on the sidewalk in front of the branch.

Wells Fargo security closed the bank branch and contacted the San Francisco Police Department and eventually the nonviolent protestors voluntarily departed from the bank branch after delivering demands to the bank manager. Then, a number of Foreclosure and Eviction Fighters and representatives from organizations such as the National Association for the Advancement of Color People (NAACP) spoke to the crowd assembled in front of the branch and demanded an end to predatory foreclosures, short sales, and evictions, as well as demanding that Wells Fargo provide fair deal loan modifications for all homeowners, particularly those who are elderly, disabled, have school-age children or life-threatening illnesses, during the holiday season and beyond.

Wells Fargo security closed the bank branch and contacted the San Francisco Police Department and eventually the nonviolent protestors voluntarily departed from the bank branch after delivering demands to the bank manager. Then, a number of Foreclosure and Eviction Fighters and representatives from organizations such as the National Association for the Advancement of Color People (NAACP) spoke to the crowd assembled in front of the branch and demanded an end to predatory foreclosures, short sales, and evictions, as well as demanding that Wells Fargo provide fair deal loan modifications for all homeowners, particularly those who are elderly, disabled, have school-age children or life-threatening illnesses, during the holiday season and beyond.

Perhaps anticipating these protests, Wells Fargo announced yesterday that it will suspend foreclosure and eviction proceedings during the period from December 19 to January 2.

Perhaps anticipating these protests, Wells Fargo announced yesterday that it will suspend foreclosure and eviction proceedings during the period from December 19 to January 2.

Media coverage: KQED KTVU CBS KGO SF Weekly SF Examiner Bernalwood SF Bayview

Videos: KTVU Video

Photos:

ACCE members, Occupy Bernal, Occupy Noe, Occupy Action Council SF, Senior and Disability Action, and Allies,

ACCE members, Occupy Bernal, Occupy Noe, Occupy Action Council SF, Senior and Disability Action, and Allies,

The movement for housing justice and bank accountability continues. We have had many victories and saved many homes, but the Big Banks continue to operate as “Community Killers”, wreaking havoc on our families and neighborhoods. It’s time to demand Wells Fargo and other big banks fix the economy by addressing the massive underwater crisis facing California. It’s time for the resetting of mortgages to fair market value.

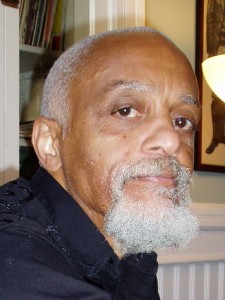

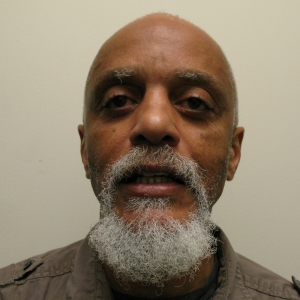

What: Don’t Sell Californians Short — Affordable Mortgages, NOT Short Sales! Justice for the Wells 26! No Holiday Foreclosures or Evictions! Speeches by Wells Fargo Foreclosure and Eviction Fighters Larry Faulks and Bernetta Adolph.

When: Thursday, December 6th 10:30am

Where: Meet at Bayview KFC parking lot, intersection of 3rd St. and Jerrold

December 6th is the one year anniversary of Occupy Our Homes, a movement led by Occupy activists and community group allies that has helped to create the political will for a stronger settlement between the Attorney General and the 5 largest banks, as well as passage of Californians landmark foreclosure prevention bill, the CA Homeowner Bill of Rights.

A recent report by the independent monitor of the CA AG settlement showed that the “relief” banks banks claim to be providing is based more on Short Sales than anything else. We demand mortgage relief that KEEPS CALIFORNIANS IN OUR HOMES!

Please join us on Thursday!

Contact Erin for more information – 503-816-4593