Here is a San Francisco foreclosure auctions report with data as of March 17, 2012.

Properties scheduled for foreclosure auction: 615 (down from 618 last week)

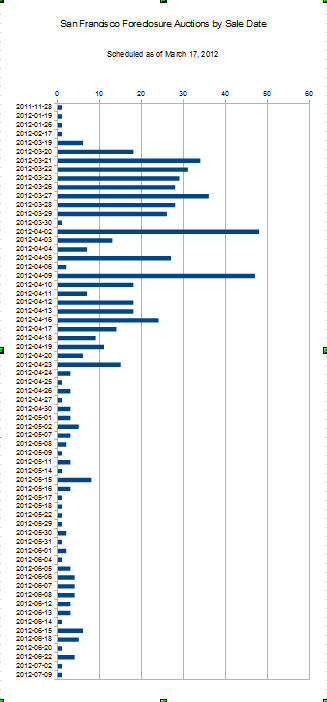

# of auctions by sale date (may vary slightly due to small numbers of misfiled or misidentified lenders in data set):

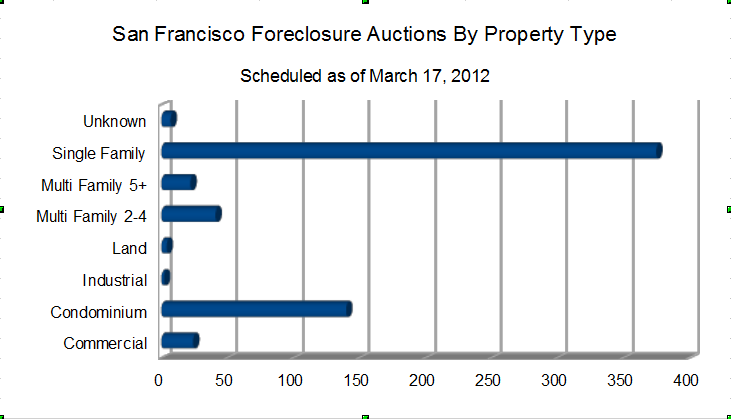

# of auctions by property type (may vary slightly due to small numbers of misfiled or misidentified lenders in data set):

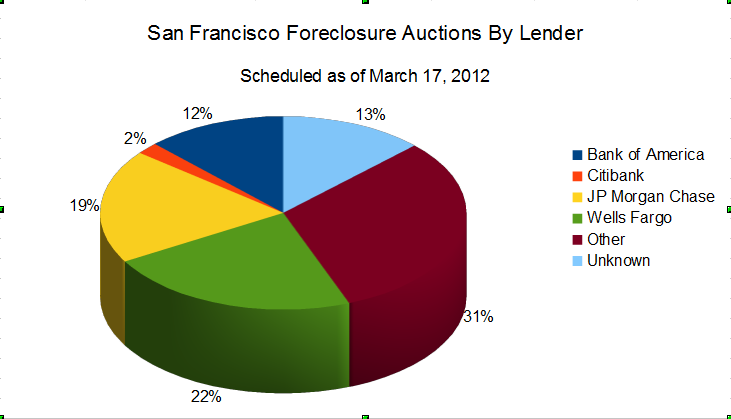

Percentage of auctions for top lenders (may vary slightly due to small numbers of misfiled or misidentified lenders in data set):

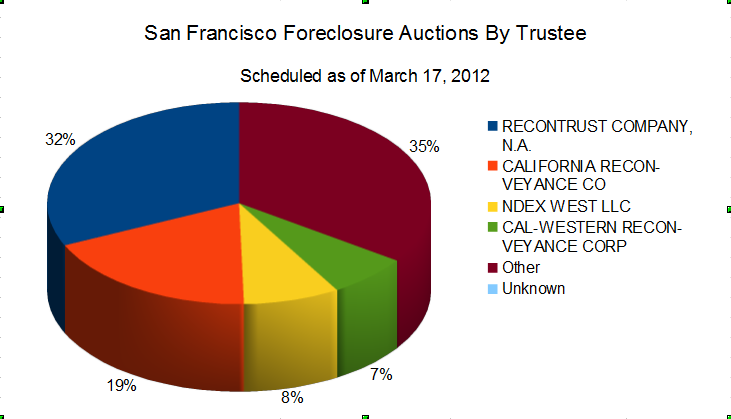

Percentage of auctions for top trustees (may vary slightly due to small numbers of misfiled or misidentified trustees in data set):

Source: Data aggregated from Foreclosure Radar.