Freddie Mac plans to evict Sally Scott and her family from their St. Louis home at 8:00am this Thursday, January 17.

Freddie Mac plans to evict Sally Scott and her family from their St. Louis home at 8:00am this Thursday, January 17.

After their staff refused a loan modification approved by a HUD-certified counselor, Freddie Mac auctioned back to themselves the home of 65-year-old Sally Scott and her family in west St. Louis, Missouri. Her 84-year-old husband Bob is a WWII and Korean War veteran who was disabled by a stroke five years ago. Sally, her disabled husband Bob, and her 26-year-old mentally handicapped “special child” Susie live in a constant state of fear, not knowing when the county sheriff will show up to evict them and throw all their belongings out onto the sidewalk.

They originally obtained their loan from Southwest Bank, then it was transferred twice over the last 11 years, ending up serviced by Select Portfolio Servicing and owned by Freddie Mac.

Please take action to help keep the Scott family in their home–

1) Call and email Freddie Mac staff with the following message:

* Donald H. Layton, CEO, at +1 703-903-2000 (say “Donald Layton” to transfer call)

* Brad German, Public Relations, at +1 703-903-2437

* Patti Boerger, Media Relations, at +1 703-903-2445

* Chad Wandler, Media Relations, +1 703-903-2446 or +1 571-236-2533 (cell)

* Aaron Elking, Attorney at Martin, Leigh, Laws, & Fritzlen, in Kansas City, +1 314-862-5200 or +1 636-534-7600

To: Donald_Layton@freddiemac.com, Brad_German@freddiemac.com, Patricia_Boerger@freddiemac.com, Chad_Wandler@FreddieMac.com, ame@mllfpc.com

Cc: action@occupytheauctions.org

Subject: Postpone Eviction of Scott Family in St. Louis (SPS Loan #0009962887)

Please immediately postpone the imminent eviction of the Scott family at 115 Ladue Pines Drive in Creve Coeur, St. Louis County, to give them time to negotiate a fair deal loan with Select Portfolio Servicing (SPS) and Freddie Mac. The family includes an elderly couple, one of whom is a disabled veteran of two wars, and a mentally handicapped daughter. They have more than $4,000 in monthly regular and disability income. Their loan number with SPS is 0009962887.

2) Call the St. Louis County Sheriff with the following message:

* Jim Buckles, St. Louis County Sheriff, at +1 314-615-4724

Please postpone the eviction of the Scott family at 115 Ladue Pines Drive in Creve Coeur, St. Louis County, to give them more time to negotiate a fair deal loan with Select Portfolio Servicing and Freddie Mac. The family includes an elderly couple, one of whom is a disabled veteran of two wars, and a mentally handicapped daughter.

3) Please sign a petition, already signed by more than 900 people, on behalf of the Scott family and veterans raised more than $10,000 to assist the family.

4) If you live in St. Louis and can provide local support for the Scott family, please contact us at action@occupytheauctions.org … find out about and help make plans for an eviction witness or eviction defense action this Thursday.

Thanks for supporting a good Missouri neighbor!

Web address for this alert and updates: http://occupytheauctions.org/wordpress/?p=7894

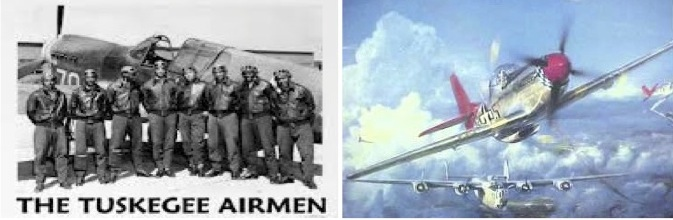

Please call/email Wells Fargo to stop the foreclosure auction of the home of Tuskegee Airman Benjamin Reed and his family on January 24, 2013:

Please call/email Wells Fargo to stop the foreclosure auction of the home of Tuskegee Airman Benjamin Reed and his family on January 24, 2013: