Update as of 10:30am on January 14, 2013: Despite the protests of Dr. Lehman Brightman’s son Quanah and supporters from the Native American community, Poor Magazine, the Alliance of Californians for Community Empowerment, Occupy Bernal, and others, Wells Fargo went ahead and sold off Dr. Lehman’s home at the foreclosure auction at the Concord Hilton. We’ll follow Quanah’s lead in deciding whether to continue the fight to save the family’s home.

Update: A representative has indicated that Wells Fargo intends to proceed with the foreclosure auction of Dr. Lehman Brightman’s home tomorrow morning. Please take a moment to call, email, sign the petition, and if you can make it to the Concord Hilton (Golden Gate Ballroom) tomorrow morning (J14) before 9am, join the protestors trying to stop the auction (see below).

Take action to stop Wells Fargo from auctioning off Lehman Brightman and family’s home–

Take action to stop Wells Fargo from auctioning off Lehman Brightman and family’s home–

- Contact Wells Fargo staff with the following phone and email message:

- Brenda Wright, Senior VP of Community Relations, +1 415-623-7738

- Alfredo Pedroza, Director of California Local Government Relations, +1 415-396-0829

- Ruben Pulido, Communications Staff, +1 415-852-1279

- Tim Rector, President, +1 515-324-7870

- John Stumpf, CEO, +1 866-878-5865

Sample message:

To: brenda.wright@wellsfargo.com, alfredo.pedroza@wellsfargo.com, ruben.pulido@wellsfargo.com, Timothy.P.Rector@wellsfargo.com, john.g.stumpf@wellsfargo.com

Cc: action@occupybernal.org

Subject: Stop the January 14 Foreclosure Auction of Lehman Brightman’s Home (loan# 0044126233)Dear Wells Fargo staff,

Please take IMMEDIATE action to stop the January 14 foreclosure auction of Lehman Brightman and his family’s home at 2434 Faria Avenue (loan# 0044126233) in Pinole, California, and offer them a fair deal loan modification.

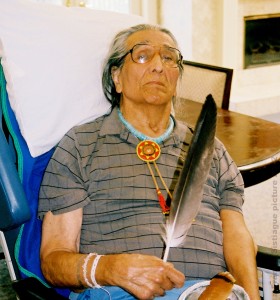

Lehman Brightman, a Native American civil rights pioneer, is now 82 years old and had a stroke in 2011. The Brightman home serves not only as a shelter for the family, but as a resource center for the Native American civil rights movement.

World Savings, a bank infamous for its discriminatory practices, had sold the Brightman family a predatory loan. Wells Fargo acquired World Savings’ loans and is refusing to work with Lehman Brightman’s sons on a fair deal loan modification to save the family home.

Please also meet the demands for each of the 29 families who Wells Fargo has put at risk of foreclosure and eviction and stop dual tracking by continuing to list foreclosure auctions while negotiating loan modifications.

Stop contributing to the rash of deaths by foreclosure! Stop the single-minded greedy focus on profit! Stop ignoring the health and well-being of your customers and the communities where we live! Take whatever action is necessary to keep distressed families in their homes!

This is an URGENT request, so please respond right away.

Sincerely,

your name here

- Sign the petition at http://www.change.org/petitions/wells-fargo-bank-cal-western-reconveyance-corp-stop-the-foreclosure-of-dr-lehman-brightman-s-home

- Attend the protest to stop the foreclosure auction at 8:30am on Monday, January 14, at the Concord Hilton, 1970 Diamond Boulevard, Concord, CA 94520.

Background:

Video of Lehman Brightman’s son Quanah Brightman providing testimony at the San Francisco Employee Retirement System Retirement Board meeting on January 9, 2013:

Dr. Lehman Brightman was one of the founders of the Native American civil rights movement. He founded the first Native American Studies Program at the University of California at Berkeley and worked tirelessly for civil rights and to improve the educational opportunities and living conditions of Native Americans.

Wells Fargo is #1 in San Francisco foreclosures. San Francisco’s Mayor and Board of Supervisors have unanimously requested a halt to foreclosures and related evictions, especially since San Francisco Assessor-Recorder’s report showing that 84% of foreclosures have at least one legal violation and due to Wells’ $175 million settlement paid to resolve allegations of racial discrimination in providing mortgage loans in San Francisco’s Bayview-Hunters Point and other neighborhoods.

Wells Fargo’s “waterfall” model, along with similar policies from other lenders, ensures that the bank can squeeze the most money possible from homeowners struggling to make payments while finally discarding them like trash if the bank can’t make a profit on every single loan. Running a mortgage loan business means assuming risks, especially after receiving billions in bailout funds from the taxpayers, many of whom are Wells’ mortgage loan borrowers.

This alert brought to you by ACCE, Occupy Bernal, and other supportive organizations coordinated within the Occupy the Auctions and Evictions campaign.

Links: Wells 29 Action Alert Wells 29 Action Flyer (four to page) Wells Pays $175 Million to Resolve Allegations of Racial Discrimination in Providing Mortgage Loans Occupy Our Homes Wells Fargo Bayview Branch Action Occupy Wells Fargo Noe Branch Occupy Wells Fargo HQ Occupy Senior and Veteran Evictions and Foreclosures (Occupy Anniversary) Upcoming Bank Auctions of Foreclosure/Eviction Fighter Homes Foreclosure/Eviction Fighter Profiles

For updates and this action alert: http://occupytheauctions.org/wordpress/?p=7839