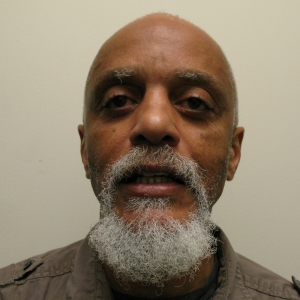

Larry Faulks’ family has owned their Diamond Heights home since it was first built in 1962. He’s 59 now and is disabled. He lives with his disabled brother and a renter. It’s where he and his brother grew up.

Larry Faulks’ family has owned their Diamond Heights home since it was first built in 1962. He’s 59 now and is disabled. He lives with his disabled brother and a renter. It’s where he and his brother grew up.

He first applied for a mortgage modification after becoming disabled due to a serious illness and failed surgery in 2010. Wells Fargo Bank lost documents again and again and again, then sold his house at a foreclosure auction to an investor from DMG Asset Management on May 17, 2012, without even notifying him about the sale. Wells Fargo sold the house before approving or denying the modification. Larry believes that this dual-tracking was banned in the April 2011 Enforcement Action by the Comptroller.

DMG Asset Management, the company that bought the house, planned to evict him on October 10, 2012, but postponed the eviction when Occupy and ACCE protested, demanding that DMG sell the home back to Wells Fargo for a loan modification. Even though Wells came to the table for negotiations, DMG has not postponed the eviction again. DMG plans to evict Larry on November 7, 2012.

Larry complained about the sale to the Comptroller, the HUD liaison to the White House, Senator Feinstein’s office, HUD, HAMP, the Dept. of the Treasury, and the Comptroller of the Currency conducted an investigation. Wells Fargo responded with three conflicting explanations of what happened. These explanations contained errors, omissions, and misleading statements.

Larry can prove with hard evidence that Wells Fargo misled these people and agencies. He has five letters from Wells Fargo that promised not to sell the house while a loan modification was under review. Nonetheless, after Wells Fargo gave these people and agencies their conflicting explanations, his case was closed.

The house was not underwater. Using the numbers that the bank presented at the auction, he had upwards of a $1 million in equity that’s now vanished. There was no speculation involved — he inherited the house in 2007. His family has owned the house for 50 years.

Links: Wells 27 Action Flyer (four to page) Wells Pays $175 Million to Resolve Allegations of Racial Discrimination in Providing Mortgage Loans Larry Faulks Profile Larry Faulks Eviction Witness DMG Asset Management Profile Occupy DMG Home Action Occupy Wells Fargo Noe Branch SF Chronicle Coverage Bay Area Reporter Coverage Occupy Wells Fargo HQ Occupy Senior and Veteran Evictions and Foreclosures (Occupy Anniversary) Upcoming Bank Auctions of Foreclosure/Eviction Fighter Homes Foreclosure/Eviction Fighter Profiles

I know Larry personally, and have witnessed the impropriety of Wells Fargo Bank, step by step, as they lied and cheated him out of his home. And then through the machinations of dealing with DMG Asset Management, hearings in court, costly extensions of his eviction–that amount to exorbitant “rents” for remaining in the house–all to take away what is rightfully his—his home.

Wells Fargo should end this tragedy by buying back the house from DMG. But, further, Wells Fargo Bank should be required to remit all the expenses Larry has been required to pay to defend his position, to say nothing of an equitable sum to adjust for their mismanagement of his case, and the hoops they have made him jump through for over two years.

Is there no justice in America anymore?

What about the thousands of other people across the USA whom the banks are treating similarly? Where is their justice?

Jamey D. Allen