Bank Management are people who have the power to make or influence decisions of the banks to evict our neighbors from their homes, foreclose on their homes, and/or sell their homes at foreclosure auctions due to predatory or for-profit mortgage loans.

Bank Conglomerates

Ally

Owner of bankrupt GMAC Mortgage home loan corporation. Headquarters in Detroit, Michigan.

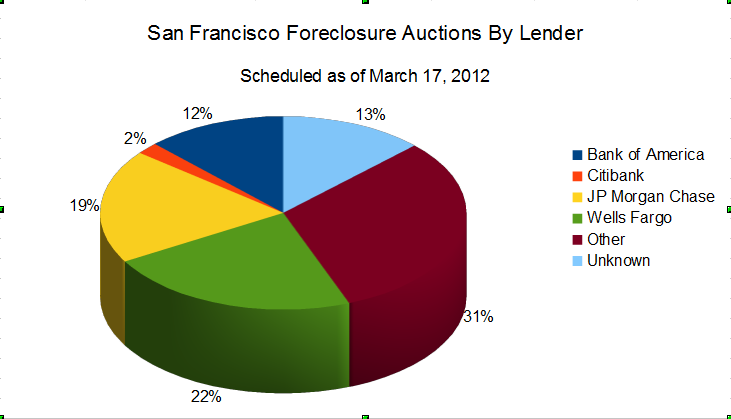

Bank of America

Headquarters in Charlotte, North Carolina. Acquired Countrywide.

Citigroup

Headquarters in New York, New York.

Fannie Mae

The Federal National Mortgage Association, nicknamed “Fannie Mae”, is a government sponsored enterprise (GSE) designed to facilitate a secondary market, or “securitization” of mortgage loans. The U.S. government, specifically the Federal Housing Finance Agency (FHFA), took over Freddie Mac, along with Fannie Mae, on September 7, 2008, and the U.S. Treasury has pumped billions into purchases of Freddie Mac stock to prop up the enterprise. Headquarters in Washington, D.C..

- Timothy J Mayopoulos, CEO, +1 202-752-7000 (and +1 877-753-0562?)

Freddie Mac

The Federal Home Loan Mortgage Corporation, nicknamed “Freddie Mac”, is a government sponsored enterprise (GSE) designed to facilitate a secondary market, or “securitization” of mortgage loans. The U.S. government, specifically the Federal Housing Finance Agency (FHFA), took over Freddie Mac, along with Fannie Mae, on September 7, 2008, and the U.S. Treasury has pumped billions into purchases of Freddie Mac stock to prop up the enterprise. Headquarters at 8000-8250 Jones Branch Drive in McLean, Virginia, tel. +1 800-424-5401. Website at www.freddiemac.com.

- Donald H. Layton, CEO, +1 703-903-2000 (say “Donald Layton” to transfer call), Donald_Layton@freddiemac.com

- Brad German, Public Relations, +1 703-903-2437, Donald_Layton@freddiemac.com

- Patti Boerger, Media Relations, +1 703-903-2445, Donald_Layton@freddiemac.com

- Chad Wandler, Media Relations. +1 703-903-2446, Donald_Layton@freddiemac.com

JP Morgan Chase

Headquarters in New York, New York, and biggest U.S. lender by assets.

- Jamie Dimon, CEO, +1 212-270-1111, Jamie.Dimon@chase.com or executive.office@chase.com

- Peter Barker, California Chair, +1 888-342-6441

- Cristina Salvatore, New York Executive Office of Modifications, +1 877-496-3138 direct ext. 3825064

- Maricela Luna, Texas Executive Office of Escalated Modifications, +1 877-496-9032 ext. 3233301

- Amy Bonitatibus, spokesperson

Nationstar

Acquired Aurora mortgage loans. Fortress Investment Group owns 77% of Nationstar. Headquarters at 350 Highland Drive in Lewisville, Texas (outside Dallas). Tel: +1 469-549-2000. Web: www.nationstarmtg.com

PNC Bank

Headquarters in Pittsburgh, Pennsylvania.

- James E. Rohr, CEO, +1 412-762-2294 (may transfer to Executive Complaint Office voicemail) or 412-963-6133 (home), james.e.rohr@pnc.com or james.rohr@pnc.com

- William Demchak, President, at +1 917-348-1173 (cell)

- Thomas Hyland, Senior Vice President, at +1 212-527-3938

- Frederick Solomon, Vice President of Corporate Communications, at +1 412-762-7544

Select Portfolio Servicing

Wells Fargo

Headquarters in San Francisco, California. Largest U.S. mortgage servicer and lender. Acquired America’s Servicing Company, Wachovia, and World Savings.

Links: Wells Fargo Loan Modification Policies (internal documents) “Responsible Lending” Practices “Help” for Homeowners

- John Stumpf, CEO, +1 866-878-5865 or for America’s Servicing use +1 301-815-3510, john.g.stumpf@wellsfargo.com

- Board of Directors, BoardCommunications@wellsfargo.com:

- John D. Baker II, Exec. Chairman, Director of Patriot Transportation Holding, Address 1:, 192 Sea Hammock Way, Ponte Vedra Beach, FL 32082, +1 (904) 543-8196, and Address 2:, 501 Riverside Ave, Jacksonville, FL 32202. Company contact info: Patriot Transportation Holding, Inc, 501 Riverside Ave., Ste 500, Jacksonville, FL 32202, +1 (877) 704-1776, jmilton@patriottrans.com

- Elaine Chao, 217 C St NE, Washington, DC 20002, +1 (202) 543-7063 or +1 (202) 543-7063, At Heritage Foundation:. Email: staff@heritage.org with Subject line: “To Elaine Chao”, Media information line: +1 (

202) 675-1761

- John Chen, CEO of Sybase (locally based), Sybase contact info: Sybase iAnywhere, A subsidiary of Sybase

, One Sybase Drive

Dublin, CA 94568,

Phone: +1 (519) 883-6898,

Toll Free: 1-800-SYBASE5 (792.2735)

, Email: contact_us@ianywhere.com, jchen@sybase.com?, John.chen@sybase.com?

- Lloyd H. Dean, CEO of Dignity Health, formerly Catholic Healthcare West,

CHW info: 185 Berry Street, Suite 300, San Francisco, CA 94107, +1 (415) 438-5500, Contact form: http://www.chwhealth.org/Who_We_Are/Contact_Us/index.htm, @dignityhealth.com?

- Susan E. Engel, CEO, Portero, Inc, Portero contact info: 28 Kaysal Court, Suite 1, Armonk, NY 10504-1378, United States, Phone: +1 (914) 730-0208, www.portero.com

- 120 75th St, New York, NY 10021, (952) 824-6438, (212) 734-1449

- Enrique Hernandez, Jr., Chairman, CEO of Inter-Con Security Systems, Inc.

- Donald M. James, Chairman, CEO of Vulcan Materials Company, +1 (205) 298-3000, jamesd@vmcmail.com?

- Mackey J. McDonald. Retired Chairman, VF Corporation

- Nicholas G. Moore, Retired Global Chairmam of Pricewaterhouse Coopers

- Federico F. Peña, Senior Advisor, Vestar Capital Partners, Seventeenth Street Plaza, 1225 17th Stre

et, Suite 1660, Denver, CO 80202, +1 (303) 292-6300

- Philip J. Quigley, Retired Chairman, President, CEO, of Pacific Telesis Group

- Judith M. Runstad, Of Counsel, Foster Pepper PLLC, 206-447-8897 (Seattle), runsj@foster.com

- Stephen W. Sanger, Retired Chairman of General Mills, Inc.

- Susan G. Swenson, Retired President and CEO of Sage Software, Inc.

- Patricia Callahan, Senior Executive Vice President, Chief Administrative Officer, +1 800-869-3557, Pat.Callahan@wellsfargo.com

- Avid Modjtabai, Senior Executive Vice President, Consumer Lending, +1 800-869-3557, Avid.Modjtabai@wellsfargo.com

- James Strother, Senior Executive Vice President, General Counsel Legal Group, +1 415-396-1793, James.Strother@wellsfargo.com

- Ruben Pulido, Asst. Vice President, Communications, ruben.pulido@wellsfargo.com

- Diana Stauffer, Senior VP Regional Servicing Director,

+1 (925) 552-4347 (disconnected), diana.stauffer@wellsfargo.com (email undeliverable)

- Tom Goyda, spokesperson

- Alfredo Pedroza, Director California Local Government Relations, 415-396-0829, alfredo.pedroza@wellsfargo.com

Links: Add Bank Management to List