The San Francisco Employee Retirement System (SFERS) Retirement Board decided on April 10, 2013, not to decide anything at all on the two predatory banking motions Commissioner Herb Meiberger proposed to the Retirement Board. The vote took place in a roundabout way after much comment from the public and the commissioners in Commissioner and SF Supervisor Malia Cohen’s absence (due to illness) and once SFERS Retirement Board President Wendy Paskin-Jordan and Commissioner Brenda Wright, a senior Wells Fargo employee, had recused themselves from the deliberations. Commission Victor Makras disclosed ownership of about $11,000 of Bank of America stock, which perhaps also should have been grounds for recusal.

The San Francisco Employee Retirement System (SFERS) Retirement Board decided on April 10, 2013, not to decide anything at all on the two predatory banking motions Commissioner Herb Meiberger proposed to the Retirement Board. The vote took place in a roundabout way after much comment from the public and the commissioners in Commissioner and SF Supervisor Malia Cohen’s absence (due to illness) and once SFERS Retirement Board President Wendy Paskin-Jordan and Commissioner Brenda Wright, a senior Wells Fargo employee, had recused themselves from the deliberations. Commission Victor Makras disclosed ownership of about $11,000 of Bank of America stock, which perhaps also should have been grounds for recusal.

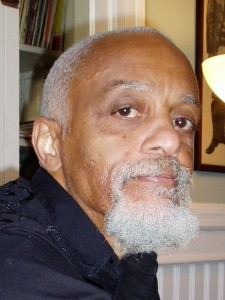

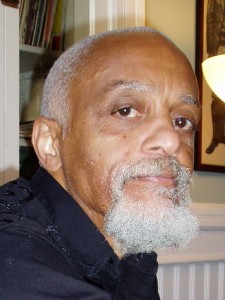

After much discussion from the standing-room only crowd, including lots of Wells Fargo employees paid to attend and representatives from nonprofit organizations receiving Wells Fargo funds, as well as presentation of a petition in support of the motions signed by more than 130 people, Commissioner Meiberger was unable to get a second for the motion. Then, Commissioner Makras proposed a negative motion to stop further deliberations on Herb’s motion, for which he got a second, but could not get a majority vote since Commissioner and police officer Brian Stansbury joined Commissioner Meiberger in opposing the negative motion. However, when Commissioner Meiberger again proposed the original motion, Commissioner Stansbury still did not second the motion, so the Commission did nothing at all.

If the motion should come up with Commissioner Cohen present, it seems that she could provide the necessary second for the original motions and would perhaps be able to cast the deciding vote yea or nay on at least the first, if not also the second motion.

Go to: Media Coverage Videos Audio Photos Background Links

San Francisco Business Times (note: incorrectly states that activists protested at Brenda Wright’s home) San Francisco Examiner

Thanks to Steve Zeltzer for the first summary video above.

Thanks to John of Bright Path Video for the summary videos above (parts I and II).

Current and retired city employees, Foreclosure and Eviction Fighters, and supporters from Service Employees International Union (SEIU) 1021, Alliance of Californians for Community Empowerment (ACCE), Occupy Bernal, Occupy Noe, and the Occupy the Auctions and Evictions Campaign provided important testimony about the illegal, predatory, and discriminatory practices of banks like Wells Fargo, JP Morgan Chase, and Bank of America at meeting of the San Francisco Employee Retirement System Retirement Board on January 9, February 13, and March 13, 2013.

Current and retired city employees, Foreclosure and Eviction Fighters, and supporters from Service Employees International Union (SEIU) 1021, Alliance of Californians for Community Empowerment (ACCE), Occupy Bernal, Occupy Noe, and the Occupy the Auctions and Evictions Campaign provided important testimony about the illegal, predatory, and discriminatory practices of banks like Wells Fargo, JP Morgan Chase, and Bank of America at meeting of the San Francisco Employee Retirement System Retirement Board on January 9, February 13, and March 13, 2013.

At each meeting, the group asked the Retirement Board to uphold its fiduciary responsibility to investigate the illegal, predatory, and discriminatory practices of the banks, to request that the banks stop these practices, to sponsor shareholder resolutions if they don’t stop, and to divest from the banks’ stocks if the shareholder resolutions do not succeed. Some of the Commissioners responded favorably to the public comment testimony.

Since the last SFERS Retirement Board meeting, a number of organizations have declared their support of the motions under consideration at the April 10 meeting, including the Retired Employees of the City and County of San Francisco (RECCSF), Housing Rights Committee of San Francisco, and the San Francisco Tenants Union.

The San Francisco Employee Retirement Systems (SFERS) handles investments for pension funds for current and retired San Francisco city employees. SFERS has policies that include “Social Investment Procedures” adopted at the SFERS Retirement Board meeting of September 27, 1988, which requires the SFERS Retirement Board when making investments in stocks, mutual funds, and so on, to consider:

“Community Relations: the relationship of the corporation to the communities in which it operates shall be maintained as a good corporate citizen through observing proper environmental standards, supporting the local economic, social and cultural climate, conducting acquisitions and reorganizations to minimize adverse effects and not discriminate in making loans or writing insurance.” (emphasis added by Occupy the Auctions)

A record number of San Francisco City and County employees, as well as others residents of San Francisco and beyond, are facing mortgage loan defaults, foreclosures, and evictions (an estimated 12,000 foreclosures in San Francisco between 2008 and 2011). Many have already lost their homes.

Wells Fargo, JP Morgan Chase, and Bank of America are the market leaders in foreclosures and related evictions here in San Francisco and statewide. These banks engaged in illegal, predatory, and discriminatory practices by putting African-American and Latino borrowers into higher-cost, subprime loans than white borrowers. In fact, in July 2012, Wells Fargo agreed to pay $175 million to settle a United States Department of Justice lawsuit for its discriminatory mortgage lending practices affecting more than 30,000 borrowers, including those banking at the Bayview Wells Fargo branch.

Billions of dollars in mortgage lender settlements with government agencies and other parties have to date not managed to solve the mortgage lending crisis, making mortgage lenders and servicers a potential medium-term and long-term investment risk. Illegal, predatory, and discriminatory foreclosures harm all homeowners, erode the property tax base, and cost local governments, hurting the standard of living of retirees and all working people.

Wells Fargo is #1 in San Francisco foreclosures. San Francisco’s Mayor and Board of Supervisors have unanimously requested a halt to foreclosures and related evictions, especially since San Francisco Assessor-Recorder’s report showing that 84% of foreclosures have at least one legal violation and due to Wells’ $175 million settlement with the United States Department of Justice paid in response to allegations of racial discrimination in providing mortgage loans in San Francisco’s Bayview-Hunters Point and other neighborhoods.

Wells Fargo is #1 in San Francisco foreclosures. San Francisco’s Mayor and Board of Supervisors have unanimously requested a halt to foreclosures and related evictions, especially since San Francisco Assessor-Recorder’s report showing that 84% of foreclosures have at least one legal violation and due to Wells’ $175 million settlement with the United States Department of Justice paid in response to allegations of racial discrimination in providing mortgage loans in San Francisco’s Bayview-Hunters Point and other neighborhoods.

Wells Fargo’s “waterfall” model, along with similar policies from other lenders, ensures that the bank can squeeze the most money possible from homeowners struggling to make payments while finally discarding them like trash if the bank can’t make a profit on every single loan. Running a mortgage loan business means assuming risks, especially after receiving billions in bailout funds from the taxpayers, many of whom are Wells’ mortgage loan borrowers.

Wells Fargo is putting 32 families at risk of losing their homes due to foreclosure and related evictions during this holiday season. Wells Fargo is foreclosing on and evicting veterans and disabled and senior homeowners and families with children, as well as targeting homeowners with life-threatening illnesses. Wells Fargo has engaged in predatory, fraudulent, and racist lending practices and has contributed to a rash of foreclosure deaths.

Petition Supporting SFERS Motions April 10 Media Advisory Agenda for SFERS Retirement Board Meeting on April 10, 2013 Staff Memo for SFERS Retirement Board Meeting on April 10, 2013 SFERS Social Investment Policy Members of SFERS Retirement Board SFERS Retirement Board Meeting on March 13, 2013 SFERS Retirement Board Meeting on January 9, 2013 San Francisco Business Times KCBS (including audio segment) Wells Pays $175 Million to Resolve Allegations of Racial Discrimination in Providing Mortgage Loans Occupy Our Homes Wells Fargo Bayview Branch Action Occupy Wells Fargo Noe Branch Occupy Wells Fargo HQ Occupy Senior and Veteran Evictions and Foreclosures (Occupy Anniversary)