On February 4, 2013, auctioneers sold two family’s homes at the foreclosure auction in San Francisco: auctioneer Thomas of Lender Processing Services / Agency Sales and Posting (LPS/ASAP) sold 25 Lucy Street back to lender Aurora Loan Services (Nationstar / Fortress Investment Group) for $529,245.99 and auctioneer Thomas of Lender Processing Services / Agency Sales and Posting (LPS/ASAP) sold 565 Banks Street back to lender Wells Fargo for $581,017.

Auctioneer Andrew Zheng of Cal Agent Services read postponements and cancellations. Auctioneer Thomas of Lender Processing Services / Agency Sales and Posting (LPS/ASAP) read postponements and cancellations.

Auctioneer Thomas of Lender Processing Services / Agency Sales and Posting (LPS/ASAP) sold 25 Lucy Street back to lender Aurora Loan Services (Nationstar / Fortress Investment Group) for $529,245.99.

Auction investor David Levy comments on prior sale.

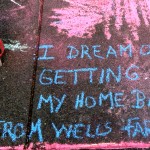

Auctioneer Thomas of Lender Processing Services / Agency Sales and Posting (LPS/ASAP) began sale of 565 Banks Street back to lender Wells Fargo for $581,017, then delayed to see if an auction investor was going to bid.

Auctioneer Thomas of Lender Processing Services / Agency Sales and Posting (LPS/ASAP) sold 565 Banks Street back to lender Wells Fargo for $581,017.

Auctioneer Andrew Zheng of Cal Agent Services read another postponement.