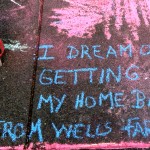

Update as of February 4: Auctioneer Thomas of Lender Processing Services / Agency Sales and Posting (LPS/ASAP) sold 565 Banks Street back to lender Wells Fargo for $581,017.

Update as of January 31: Wells Fargo has postponed the auction of Alberto and his family’s home until February 4. Please keep the calls and emails coming to get Wells Fargo to cancel the auction and offer the family a fair deal loan modification so they can remain in their home.

- Contact Wells Fargo staff with the following phone and email message:

- Brenda Wright, Senior VP of Community Relations, +1 415-623-7738

- Alfredo Pedroza, Director of California Local Government Relations, +1 415-396-0829

- Ruben Pulido, Communications Staff, +1 415-852-1279

- John Stumpf, CEO, +1 866-878-5865

Sample message:

To: brenda.wright@wellsfargo.com, alfredo.pedroza@wellsfargo.com, ruben.pulido@wellsfargo.com, john.g.stumpf@wellsfargo.com

Cc: action@occupybernal.org

Subject: Stop the Auction of Alberto Del Rio’s Home!Dear Wells Fargo staff,

Postpone the auction of Alberto Del Rio’s home at 565 Banks St., San Francisco, loan # 47339080 (owner’s name is Gloria Lomeli) and offer the family a fair deal loan modification so they can remain in their home.

Sincerely,

Your name here

- Protest on THURSDAY, January 31, 1:45pm at CITY HALL (Van Ness side)

Together we can stop predatory banks and help our neighbors!

In the past few months we’ve stalled/stopped dozens of home auctions.

Background

Alberto Del Rio is a Bernal Heights resident who grew up in his family home. He lives there with his wife and 3 kids. To help his mother have a decent retirement, the Del Rio family took equity out of the home and refinanced. But their loan from World Savings was a Pick-a-Payment loan. Lawsuits have found these sorts of loans to be predatory. World Savings sold the loan to Wachovia, which was then acquired by Wells Fargo. “Wells took advantage of me like they did so many other people. They promised us the moon,” says Alberto, who has been trying to get a loan modification since 2000. The bank has continually lost his paperwork, and refused to negotiate in good faith. The bank even advised him to stop making payments in order to qualify for a loan modification, which triggered the foreclosure process. Alberto has been working hard and succeeded in raising his income so he can qualify for a fair deal loan modification. Now, Wells Fargo is scheduled to auction his home on January 31. But we won’t let them.

As #1 in foreclosures in San Francisco, Wells Fargo is putting 29 families at risk of losing their homes due to foreclosure and related evictions. Wells Fargo is foreclosing on and evicting veterans and disabled and senior homeowners and families with children, as well as targeting homeowners with life-threatening illnesses. Wells Fargo has engaged in predatory, fraudulent, and racist lending practices and has contributed to a rash of foreclosure deaths.

As #1 in foreclosures in San Francisco, Wells Fargo is putting 29 families at risk of losing their homes due to foreclosure and related evictions. Wells Fargo is foreclosing on and evicting veterans and disabled and senior homeowners and families with children, as well as targeting homeowners with life-threatening illnesses. Wells Fargo has engaged in predatory, fraudulent, and racist lending practices and has contributed to a rash of foreclosure deaths.

Links: Stop the Foreclosures and Evictions of the “Wells 29” Prior Auction Stopped (photos and videos) Profile (old auction date)

For more info and updates: http://occupytheauctions.org/wordpress/?p=8143 or call Occupy Bernal at 415-483-9138.