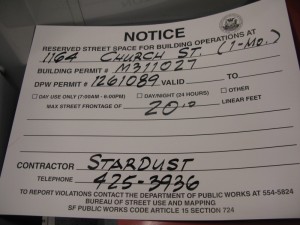

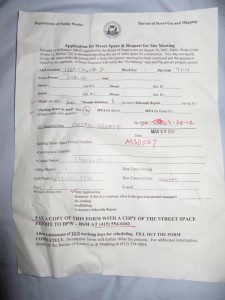

Update as of March 30: Please come shop for some great bargains the Last Chance Sale of Kathryn’s belongings from 9:00am to 6:00pm on Saturday, April 7, at 1164 Church Street in San Francisco. All proceeds will go to Kathryn’s moving expenses, storage, and rent and deposit for her, her sister, and their dog’s new home once we locate one. Kathryn and her sister are sorting through their belongings to get everything packed up before the deadline for the Wells Fargo settlement. We are asking folks who want to sign up for a shift helping with sorting, cleaning, moving trash and recycling, and assisting with a Last Chance sale of her possessions to contact communications@occupytheauctions.org.

Here are the latest pictures:

Update as of March 28: Kathryn accepted Wells Fargo’s offer of $7,500 to leave the property prior to eviction by the Sheriff, have all of her belongings moved out within 15 days, and not to sue Wells Fargo. She, her sister, and their dog are now staying at the home of a Foreclosure and Eviction Fighter. They are still looking for affordable housing and assistance with moving their belongings. If you can help, please call Renita at 415-618-9172.

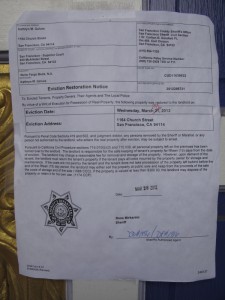

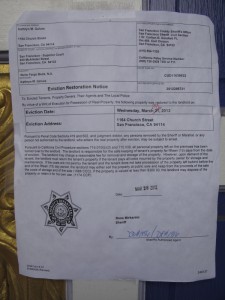

Update: Kathryn’s eviction was postponed to Wednesday, March 28, 2012. Although Occupy SF Housing was able to obtain a week’s eviction delay and is helping Kathryn negotiate some kind of settlement from Wells Fargo, she has made the difficult decision of trying to move out prior to being evicted.

Request for Assistance:

Request for Assistance:

Do you know of a place with an accessible kitchen where an elderly Noe Valley resident, her step-sister, and their dog could stay temporarily when they are evicted tomorrow morning (Wednesday) by 9:14am? Some rent money is available.

If you know of a place, please contact Kathryn’s step-sister Renita right away at 415-618-9172.

Also, if you are willing to help move Kathryn and Renita’s belonging from their home to a storage location (or know of a moving truck or storage location we could use), please contact Renita at 415-618-9172.

Please respond to this urgent action alert to stop the eviction of Foreclosure and Eviction Fighter Kathryn Galves, her sister, and their dog on this Wednesday, March 21, 2012.

Links: Take Action Shift Signup Background Protest

NOTE: Please check here for updates… if you sign up, we’ll email you and/or call you if/when the eviction is postponed.

Take Action

Please take the following actions:

- Contact the lender Wells Fargo to request:

“Subject: URGENT: Postpone Eviction of Kathryn Galves, 1164 Church St, San Francisco, Loan #0044722973”

“Please immediately direct the San Francisco Sheriff to postpone the eviction scheduled for Kathryn Galves and family at 1164 Church Street in San Francisco. Kathryn has Wells Fargo mortgage loan #0044722973 and has found a cooperative buyer for the property who is willing to retain her and her sister as tenants. Please set up a meeting right away with the Wells representative empowered to negotiate a sale of the home, Kathryn, and the prospective buyer.”

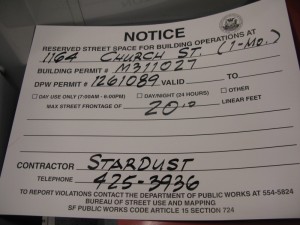

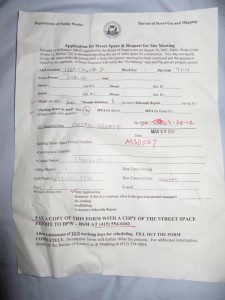

- Sign up below for a shift of eviction defense on Wednesday at the home of Kathryn Galves at 1164 Church St. near 24th St. in San Francisco.

- Join and invite your friends to the Facebook event for this eviction defense.

- Join and invite your friends to the Occupy Wells Fargo Noe Valley Protest from 9:00am to 6:00pm on Saturday, March, 24. Download and distribute Protest Flyer.

Shift Signup

Background Information

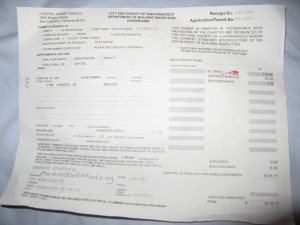

Kathryn Galves purchased her lovely home at 1164 Church Street in 1972 and the home increased in value considerably over the years. She is a military widow who banked on the increased value of her property to invest in an out-of-state property with a Section 8 (affordable public housing) tenant. The investment did not go well and she lost more to book sales customers who didn’t pay for their orders. Kathryn lives on a fixed annuity income and her live-in sister earns a meager living as a caretaker. When her financial situation went sour, Kathryn filed a Chapter 13 bankruptcy, but Wells Fargo Bank successfully challenged the bankruptcy, then foreclosed on her home and it went to foreclosure auction. No one bid for the property at auction, so it became “bank-owned”, that is, owned by Wells Fargo. Wells Fargo has filed for the San Francisco Sheriff to evict Kathryn, her sister, and their dog from her home of 40 years. Kathryn has found a long-term neighbor who is willing to purchase her home and let her, her sister, and their dog remain in the home. Despite many requests by Kathryn and the prospective buyer, Wells Fargo has refused to come to the bargaining table regarding selling the home.